What kind of company is Money Chain?

Money Chain is a professional cross-border remittance institution registered and regulated in Australia.

Established nearly 20 years ago and headquartered in Sydney, we are officially licensed by AUSTRAC (Australian Transaction Reports and Analysis Centre) and strictly comply with both Australian and international Anti-Money Laundering (AML) and Counter-Terrorism Financing (CTF) regulations.

We specialize in providing global remittance services for individual and corporate clients, covering a wide range of purposes — including overseas property purchase, migration fund transfer, tuition payments, family support, and corporate fund movements.

What is Money Chain's service coverage?

Money Chain offers two-way international remittance services between Australia and more than 30 countries and regions worldwide,including China, the United States, major European countries, Japan, Hong Kong, Malaysia, Singapore, and India.

Whether it’s personal remittance, family support, business settlement, tuition payment, cross-border investment,or trade fund transfers for import and export businesses, Money Chain provides you with secure, efficient, and cost-effective global payment solutions.

Note: Certain currencies may be restricted or temporarily unavailable for direct exchange due to international sanctions or geopolitical.

注:个别货币受国际限制或地缘冲突影响,可能无法直接兑换,但可通过其他主流货币(如 USD、AUD、EUR)间接处理。

注:个别货币受国际限制或地缘冲突影响,可能无法直接兑换,但可通过其他主流货币(如 USD、AUD、EUR)间接处理。

无论是个人汇款、家庭支持、企业结算、学费支付、跨境投资,还是企业的进出口贸易资金流转,融侨速汇都能为您提供安全、高效、低成本的跨境支付解决方案。

注:个别货币受国际限制或地缘冲突影响,可能无法直接兑换,但可通过其他主流货币(如 USD、AUD、EUR)间接处理。

无论是个人汇款、家庭支持、企业结算、学费支付、跨境投资,还是企业的进出口贸易资金流转,融侨速汇都能为您提供。安全、高效、低成本的跨境支付解决方案。

注:个别货币受国际限制或地缘冲突影响,可能无法直接兑换,但可通过其他主流货币(如 USD、AUD、EUR)间接处理。

覆盖包括 中国、美国、欧洲主要国家、日本、香港、马来西亚、新加坡、印度 等地。

无论是个人汇款、家庭支持、企业结算、学费支付、跨境投资,

还是企业的进出口贸易资金流转,融侨速汇都能为您提供

安全、高效、低成本的跨境支付解决方案。

注:个别货币受国际限制或地缘冲突影响,可能无法直接兑换,但可通过其他主流货币(如 USD、AUD、EUR)间接处理。

无论是个人汇款、家庭支持、企业结算、学费支付、跨境投资,还是企业的进出口贸易资金流转,融侨速汇都能为您提供安全、高效、低成本的跨境支付解决方案。

注:个别货币受国际限制或地缘冲突影响,可能无法直接兑换,但可通过其他主流货币(如 USD、AUD、EUR)间接处理。

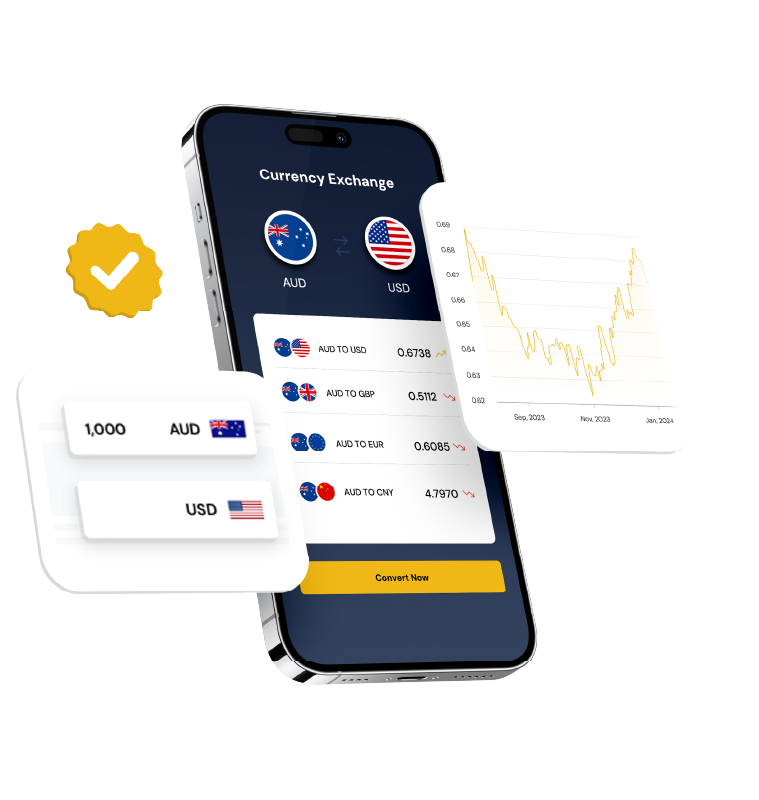

What are Money Chain's exchange rates and fees like?

Money Chain maintains long-term and stable foreign exchange partnerships, offering highly competitive market exchange rates and a transparent fee structure — with no hidden charges.

Clients making large transfers enjoy exclusive preferential rates and rate-lock services to mitigate exchange rate fluctuations.

大额客户可享专属优惠汇率与锁汇服务,提前锁定当日汇率,降低波动风险。

提醒:请在任何转款操作前,与门店或专属顾问确认账户信息,确保资金安全。

大额客户可享专属优惠汇率与锁汇服务,提前锁定当日汇率,降低波动风险。

提醒:请在任何转款操作前,与门店或专属顾问确认账户信息,确保资金安全。

How fast is Money Chain's transfer speed?

Our clearing system is connected with major global banking networks,

allowing most transfers to arrive on the same day or within 1–3 business days.

For urgent needs such as property settlements or migration fund transfers, we provide priority processing channels to ensure faster delivery.

What are Money Chain's remittance services typically used for?

• Overseas property purchase / settlement

• Migration fund transfers

• Tuition and living expenses

• Investment and family trust transfers

• Business settlements and overseas procurement

What are the advantages of Money Chain's service team?

Each client is assigned a dedicated account manager who provides personalized one-on-one support, including:

• Exchange rate consultation and quotation

• Document review and compliance guidance

• Transaction tracking and after-sales support

How can I become a Money Chain customer?

Becoming a Money Chain client is simple — just complete registration and verification to start your personalized remittance service.

Step 1: Register an Account

• Online: Visit our official website or contact your dedicated advisor to fill out the Account Opening Form and provide the required identification documents.

• In person: Bring valid identification (e.g. passport, driver's license, or other ID) to your nearest Money Chain branch, where our staff will assist you with account setup.

Both individual and corporate clients can open an account free of charge, with no hidden fees.

Step 2: Account Activation & Dedicated Supports

Our compliance team will complete the review process within one business day,and your dedicated account manager will contact you to help set up your remittance channel and lock in your exchange rate.

Once verified, you can start using Money Chain's services immediately.

Reminder: Before initiating any transfer, please confirm account details with your branch or advisor to ensure the security of your funds.

注:个别货币受国际限制或地缘冲突影响,可能无法直接兑换,但可通过其他主流货币(如 USD、AUD、EUR)间接处理。

注:个别货币受国际限制或地缘冲突影响,可能无法直接兑换,但可通过其他主流货币(如 USD、AUD、EUR)间接处理。

无论是个人汇款、家庭支持、企业结算、学费支付、跨境投资,还是企业的进出口贸易资金流转,融侨速汇都能为您提供安全、高效、低成本的跨境支付解决方案。

注:个别货币受国际限制或地缘冲突影响,可能无法直接兑换,但可通过其他主流货币(如 USD、AUD、EUR)间接处理。

无论是个人汇款、家庭支持、企业结算、学费支付、跨境投资,还是企业的进出口贸易资金流转,融侨速汇都能为您提供。安全、高效、低成本的跨境支付解决方案。

注:个别货币受国际限制或地缘冲突影响,可能无法直接兑换,但可通过其他主流货币(如 USD、AUD、EUR)间接处理。

覆盖包括 中国、美国、欧洲主要国家、日本、香港、马来西亚、新加坡、印度 等地。

无论是个人汇款、家庭支持、企业结算、学费支付、跨境投资,

还是企业的进出口贸易资金流转,融侨速汇都能为您提供

安全、高效、低成本的跨境支付解决方案。

注:个别货币受国际限制或地缘冲突影响,可能无法直接兑换,但可通过其他主流货币(如 USD、AUD、EUR)间接处理。

无论是个人汇款、家庭支持、企业结算、学费支付、跨境投资,还是企业的进出口贸易资金流转,融侨速汇都能为您提供安全、高效、低成本的跨境支付解决方案。

注:个别货币受国际限制或地缘冲突影响,可能无法直接兑换,但可通过其他主流货币(如 USD、AUD、EUR)间接处理。

Is Money Chain a secure and fully regulated service?

Money Chain is fully regulated by AUSTRAC (Australian Transaction Reports and Analysis Centre).

We strictly comply with all Anti-Money Laundering (AML) and Counter-Terrorism Financing (CTF) regulations.

All transactions are conducted within legitimate financial systems, and all customer data is kept confidential and protected under Australian privacy law.

What is the refund and cancellation policy?

If a remittance fails due to bank rejection or document issues, Money Chain will refund the full amount of the unsuccessful portion (minus any bank fees).

If you wish to cancel a transfer voluntarily, please contact your dedicated advisor as soon as possible for assistance.

为避免可能的税务问题,建议您在汇款前咨询专业的税务顾问,确保合规处理。

1. 汇款金额及频率:如果汇款金额较大或频繁,可能会引起税务机关的关注。

2. 汇款目的:如用于投资、捐赠或其他特定目的,可能涉及相关税务规定。

3. 接收国家的税务规定:不同国家对于跨境汇款有不同的税务要求。

为避免可能的税务问题,建议您在汇款前咨询专业的税务顾问,确保合规处理。

What are Money Chain's advantages?

20 Years of Experience

Nearly 20 years of local operation in Australia — experienced, trusted, and reliable.

Regulatory Compliance

Licensed and regulated by AUSTRAC, fully compliant with AML/CTF standards.

Competitive Exchange Rates

Multiple international FX partners providing real-time market-leading rates.

Fast & Reliable Settlement

Multi-currency clearing system supporting same-day transfers for large remittances.

Personalized Service

Dedicated account managers providing one-on-one professional assistance to ensure secure and compliant transfers.

为避免可能的税务问题,建议您在汇款前咨询专业的税务顾问,确保合规处理。

1. 汇款金额及频率:如果汇款金额较大或频繁,可能会引起税务机关的关注。

2. 汇款目的:如用于投资、捐赠或其他特定目的,可能涉及相关税务规定。

3. 接收国家的税务规定:不同国家对于跨境汇款有不同的税务要求。

为避免可能的税务问题,建议您在汇款前咨询专业的税务顾问,确保合规处理。

Meet Our Satisfied Customers

"Thanks to Money Chain’s professional and efficient service, my EB-5 fund transfer was smooth, compliant, and fully met USCIS requirements. I successfully obtained my green card and completed my family’s immigration plan. I highly recommend EZREMIT to anyone pursuing EB-5 immigration.

"Purchasing a home is a major milestone—especially in Australia, where timely fund transfers are essential for a smooth settlement process. I was initially concerned about the time and complexity of cross-border remittance, but the MoneyChain team handled everything swiftly and professionally. Thanks to their support, my payment was completed on time, and I successfully secured my dream home."

"They are our most trusted partner in cross-border remittance. With competitive exchange rates, fast delivery, and professional service, they provide strong support for our global operations. We highly value this partnership and look forward to a shared future of mutual success."

"Working overseas, I need a reliable way to send money home—fast, safe, and with great rates. Since switching to MoneyChain, remittance has been smooth and stress-free. My family gets the funds quickly, and I have peace of mind. Highly recommend MoneyChain to anyone sending money back home!"